NBC extends loan restructures to end of year

The National Bank of Cambodia (NBC) released a series of measures yesterday to further extend relief to customers suffering financially from the effects of Covid-19.

The measures include maintaining financial institutions’ reserves at 7 percent until further notice and extending loan restructures until Dec 31.

NBC’s announcement said customers living in “closed areas” may refinance their loans up to three times during this grace period.

The NBC also encouraged financial institutions to consider reducing or waiving fees on a case-by-case basis.

Capital reserves were first lowered to 7 percent last March to increase liquidity and lending capabilities of financial institutions.

At that time, the NBC also issued its first directive for financial institutions to restructure loans in an effort to combat the financial impact of Covid-19.

The directive said banks and financial institutions could reduce principal amounts, lower interest rates, extend pay schedules and offer grace periods as part of their restructure. Last week, the Cambodia Microfinance Association (CMA) reported that about $1.5 billion in loans had been restructured at CMA member institutions as of April.

CMA’s Executive Director Phal Vandy told local media that loans doubled from February to March this year and have increased at an even faster rate since then. Loans extended in April were seven times higher than in February and Vandy said he expects loans to increase even more in May. He noted that during the first five months of 2021, more than 35,800 loans totalling more than $176 million were refinanced.

Last month, the Association of Banks in Cambodia (ABC) and the CMA issued a joint directive ordering member financial institutions to further relax repayment measures to allow debtors to stay home during lockdowns and protect themselves from Covid-19.

The directive ordered member institutions to suspend payments, reduce interest to zero and waive accrued interest for three months.

Not all institutions appear to have followed suit, with the NBC calling out Active People’s Microfinance Institution for continuing to demand payment from customers affected by the pandemic despite guidelines that expressly forbade the practice.

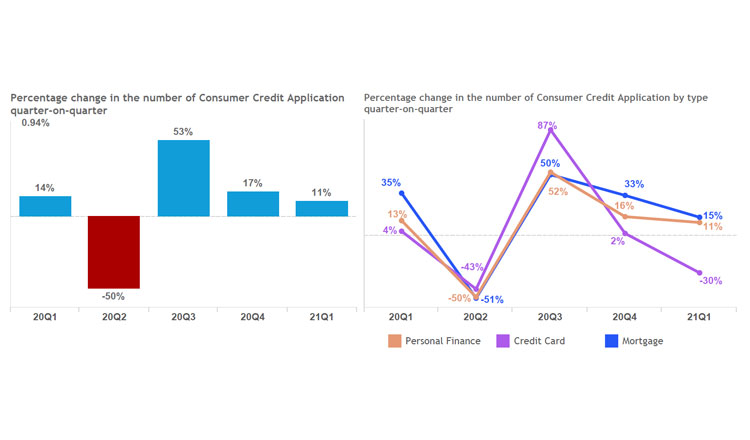

While loan restructures are on the rise in Cambodia, Credit Bureau Cambodia (CBC) reported a decrease in new loan applications during the first quarter of this year compared with previous quarters.

The loan applications studied in the report included mortgages, personal finance loans and credit cards.

Credit card applications fell the most, by 30 percent compared with Q42020. Mortgage applications decreased by 15 percent, while personal finance loans decreased by 11 percent.

CBC’s Q12021 report also found that the size of the loans decreased compared with previous quarters.