Cambodia remains susceptible to Trump tariffs, says BMI analysis

Not only will a slowdown in US economic activity weigh on Cambodia’s growth but also Cambodia remains susceptible to the potential imposition of reciprocal tariffs by US President Donald Trump, a country risk analysis published by BMI, a Fitch Solutions Company, on Friday, said.

The analysis also revises its forecast for the Kingdom’s real GDP growth and now expects the economy to pick up from an estimated 5.7 percent in 2024 to 5.9 percent in 2025, down from 6.1 percent previously and the government forecast of 6.3 percent.

“We expect that the momentum in garment, travel goods and footwear (GTF) exports will in part be weighed down by the ongoing downturn in the construction sector.

“While our forecast suggests that the economy will expand by less than its recent past where growth averaged 7.1 percent between 2015 and 2019, it will nonetheless outperform our 2025 growth forecast of 3.9 percent for emerging markets (EMs), excluding Mainland China.”

The BMI analysis pointed out that as an export-oriented economy, Cambodia is highly susceptible to external shocks.

“The onset of a second Trump presidency will worsen matters not least because protectionist US policymaking will hit emerging market exporters like Cambodia who run huge trade surpluses with the US.

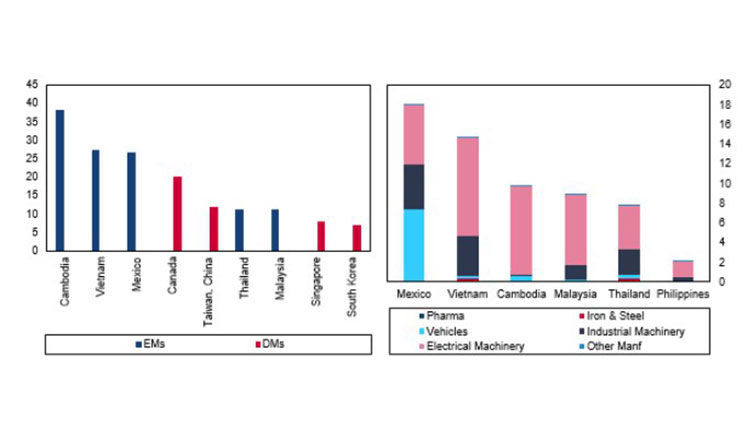

“While the nature of the protectionist shift is not yet clear, we assume that any new tariffs will focus on manufactured and industrial goods. This leaves Cambodia as the third most exposed economy behind Mexico and Vietnam to Trump’s tariffs – all of which have

large export-oriented manufacturing sectors.”

Despite these headwinds, the BMI analysis expects exports of garment, travel goods and footwear (GTF) products to emerge as the key growth driver in 2025.

“Indeed, the temporary shift in production away from Bangladesh and Myanmar amid social unrests and ongoing conflicts has benefited Cambodian exports.

“The resilient momentum in clothing exports is reflected in increased fabric imports which rose to 30.9 percent y-o-y in January 2025, from 14.6 percent in December and suggests that the recovery has extended into the first quarter of 2025. But we remain confident in our view that the strength in exports might soon falter.”

The BMI analysis further asserted that it will be challenging for the external sector to expand rapidly in the coming months against a backdrop of slowing economic activity in the US and Mainland China. “This is concerning for Cambodia given that the US is its top trading partner and whose outbound shipments are tightly linked to US imports. We expect American imports to expand at a slower pace in 2025, which will largely remove a tailwind which had propelled Cambodian exports in 2024.

“As with manufacturing exports that will remain susceptible to external demand, we further expect services exports to pick up, albeit at a more moderate pace. Since our previous update in November 2024, figures from the tourism ministry showed that while tourists’ arrivals in 2024 had surpassed that of 2019 levels, several other indicators paint a less upbeat picture.

“For one, using revenue collection from Angkor temple entrance fees as a barometer for tourist spending suggests that while total spending rose 31.4 percent y-o-y in 2024, they remain some way below their pre-pandemic standards.

“For another, as opposed to tourists from Mainland China who travel by air, rising land arrivals into Cambodia imply that arrivals from its Asean neighbours like Thailand and Vietnam are typically associated with tourists with relatively low daily expenditures.”

The analysis also highlighted weakness in the construction and real estate sectors. “We expect domestic consumption, which accounts for two-thirds of GDP, will remain slow to recover not least due to the ongoing weakness in the construction and real estate sectors.

“Data from the World Bank showed that in the first eight months of 2024, the total value of approved property development project fell by 29.1 percent y-o-y to $3.3 billion, driven primarily by a pullback in investment in residential properties.

“The bright side we think is that investments under public-private partnerships in large infrastructure projects including that of a $1.7 billion canal, as well as recently announced tax measures and forbearance will provide some support to construction activity in 2025.”

Earlier speaking to Khmer Times, economist Darin Duch said the strength of Cambodia’s export sector was evident during the first Trump administration through robust performance in garments, and footwear industries.

“I am optimistic that the US-Cambodia trade relationship remains mutually beneficial for the second Trump administration. American businesses gain from Cambodia’s affordable manufacturing options in garment, footwear, and travel goods while there is increasing potential for growth in US imports from Cambodia specifically in high-tech and agricultural sectors.”

Source: Khmer Times