Government ‘calm’ as KrisEnergy stumbles

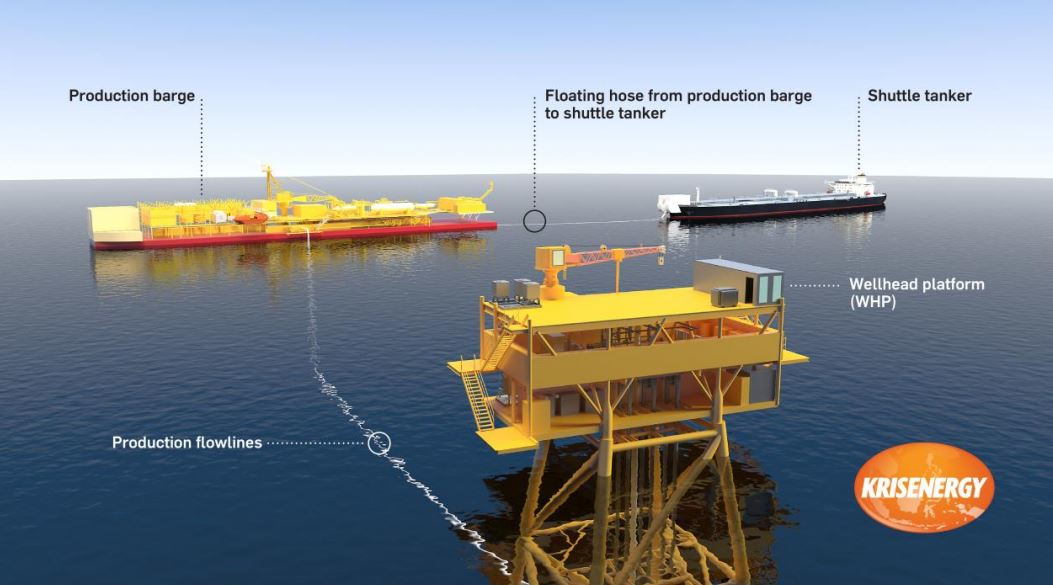

As KrisEenergy struggles to stay afloat, reports of investor “vultures” targeting purchasing the company’s assets have appeared, while the local government remains cautiously optimistic about the conundrum, noting that operations in the Khmer Basin are still “running smoothly”.

On Saturday, Cheap Sour, the director-general of the General Department of Petroleum at the Ministry of Mines and Energy, told local media that oil extraction would continue normally, even though the company has admitted it is unable to pay off its debt and is in imminent danger of collapsing. Sour said he had not received any reports from KrisEnergy regarding the debt problem and the government was still required to abide by its agreement with the oil and gas company.

“We are waiting for notifications from the company,” Sour said.

“The KrisEnergy Block A pumping operation in Sihanoukville continues to run smoothly. Regarding the debt restructuring of the company, we’ve only seen media reports but, in terms of the actual project, KrisEnergy is still operating normally.” Yesterday, Sour said he would not speculate on future decisions regarding the project. Tanya Pang, KrisEnergy’s vice-president of investor relations and corporate communications, told Khmer Times that KrisEnergy had been in frequent and regular contact with the government, but would not disclose the content of those discussions.

Pang said: “Any information outside of our announcements will be released to all stakeholders as required under the Singapore listing requirements.”

The last announcement made by the company was on April 20, when it revealed that it failed to submit a viable debt reconstruction plan and it had concerns that it may not be able to continue operating because of less-than-expected production at the Apsara oil field in the Khmer Basin.

KrisEnergy initially planned for the Apsara field to be one of several areas in the Khmer Basin to be drilled.

However, the lack of adequate production at Apsara has thrown the entire operation and company into disarray.

It’s unclear why the predicted production was so far off from the actual production. Independent outfit Netherland, Sewell & Associates Inc (NSAI) is expected to release the findings of an ongoing study on the matter soon.

As global energy media outlet Energy Voice reported, investors are keeping an eye on the company to look for opportunities to snatch up the company’s assets, but the offshore platform in Cambodian waters is not expected to be a prize asset.

The company also owns an onshore project in Bangladesh, as well as offshore projects in Indonesia and Thailand.

Energy Voice revealed that some at KrisEnergy may have known the Cambodian project, named Mini Phase 1A, would not produce as expected.

The company’s failed gamble may create losses for its shareholders (including majority owner Keppel Corporation) and the Cambodian government, which owns a 5 percent working interest stake in the project.

For now, as Sour noted, operations are continuing to proceed as normal, but for how long remains to be seen.

Meanwhile, the project’s stakeholders are left waiting for KrisEnergy’s next announcement, which should reveal NSAI’s findings and provide a more definite picture for the company’s apparently quickly fading future. Khmr Times