GDT Says Revenues Up 15% in January

The General Department of Taxation (GDT) collected about 956.76 billion Riel ($239.19 million) in tax revenue in January, up 14.74 percent compared to the same period last year.

This is a positive step towards its target of collecting more than $2.885 billion by year’s end, the GDT said in a statement on Monday.

GDT director-general Kong Vibol said in the statement that his department achieved remarkable growth last month.

However, he called on his officials to gauge the direct and indirect impact of Covid-19 on the Kingdom’s economy.

“In its mission to collect taxes for the government, GDT continually strengthens its good governance – focusing on proper administration, effective leadership and management, and meritocracy,” Vibol said.

The 2020 National Budget Law approved in November targets a 28.1 percent increase in revenue collection from customs and excise next year, reaching around $2.87 billion, or 17.72 percent of gross domestic product (GDP).

Revenue from tax collection would increase by 21.3 percent to more than $2.33 billion, accounting for 7.93 percent of GDP, it said.

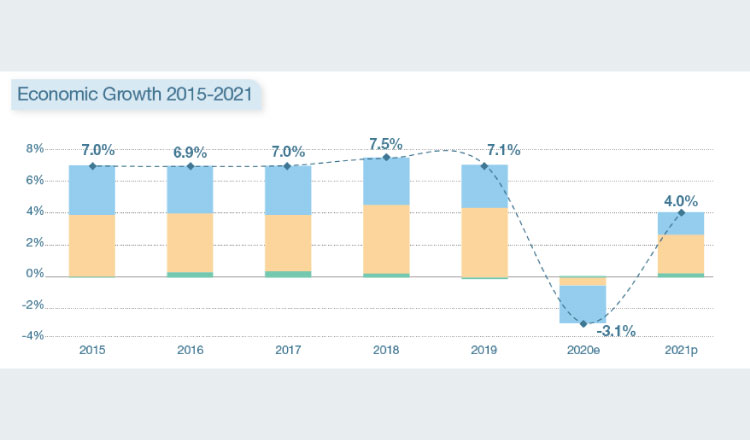

Speaking at the National Assembly in November, Minister of Economy and Finance Aun Pornmoniroth said while the Kingdom’s economy remained strong, the government had to spend more to sustain it and boost domestic revenues via the collection of tax and customs duties.

“The government has achieved good results in public financial management with the sound, sustainable and efficient collection of all types of taxes.

“This proves the strength of the Cambodian economy, despite the global economy facing greater risks than before. Higher revenue collection helps strengthen Cambodia’s budget independence, and gives the government greater control,” Pornmoniroth said.

Vibol said the GDT’s public policy is in line with the 2020 Finance Law and the Revenue Mobilisation Strategy 2019-2023 in terms of voluntary compliance, lowering tax caps and providing good-quality services.

The department strives to strengthen its rule of law, properly regulate taxes and efficiently implement its operations to ensure that taxpayers fully comply with the law, he said.

Last year, the GDT collected some 11.27732 trillion Riel, up 28.28 percent from 2018’s 8.79140 trillion Riel.